In Brief

- You will find the best dissertation research areas / topics for future researchers enrolled in Economics & Finance.

- In order to identify the future research topics, we have reviewed the Finance (recent peer-reviewed studies) on Data Analysis.

- Multiple factors that affect the bank stability and ensure that proper documentation is maintained

- Main objectives are to conduct stress tests on the banks.

Background

Banks were never anticipated to fail especially the large banks like AIG (McDonald & Paulson, 2020). Its collapse led to a complete failure of the insurance company and one of the main factors of the 2008 financial crises. The main problem was that they had given out too many loans and guarantees to the borrowers even when they did not have enough capital in the reserves for the compensation. The authorities did not consider this since they didn’t realize that a well-established firm could fall.

Hence, banks around the world must now conduct regular analysis to check the adequacy of the capital by their regulatory bodies (Baudino, Goetschmann, Henry, Taniguchi, & Zhu, 2018). This has been put in place to avoid another financial collapse. The analysis must take into consideration, the multiple factors that affect the bank stability and ensure that proper documentation is maintained. It must also be ensured that the credits are issued with enough capital as reserves to withstand the loan defaults and investment (The Basel Committe, 2006).

While American firms were largely responsible for the 2008 financial crisis, Europe and the rest of the world tool a large hit. Therefore, it cannot be ruled out that European firms will never fall since a large portion of world population bank with European firms (The Economist, 2019). The European Banking Authority (EBA) is responsible for the European banks and comes under the jurisdiction of the European Union (EU). It is located in Paris and it develops rules and regulations, which the banks in the EU must ultimately follow. Its main objectives are to conduct stress tests on the banks in order to improve the transparency in the financial system and identify the flaws and mismatches in capital and investments.

Tests

The various tests and accounting models that are available are the Stress Tests, Credit Loss, etc (Basel Committee Banking Supervision, 2017). Bank stress tests use simulation by examining the balance of the firms and analyse the financial stress that is available. This will help in identifying capital, investment, liquidity, etc. of the project and analyse the available capital. Current Expected Credit Loss (CECL) is a type of credit loss model that is used to analyse the exchange of capital and the losses arising from it (European Systemic Risk Board, 2019). Before the financial crisis of 2008, a conventional method known as Allowance for Loan and Lease Losses (ALLL) were used, however, in this type of model it does not adjust the reserve levels as per the required conditions. Instead, it depends on the losses that incur but not realized. This means that it will not be certain when the cash flow will take place in the future. This negative outlook of the credits was not considered during the financial crisis and the reserves were not adjusted for future expected losses. Hence, the improved CECL approach identifies the credit loss by considering the factors previously avoided (Cohen & Edwards, 2017).

European Perspective

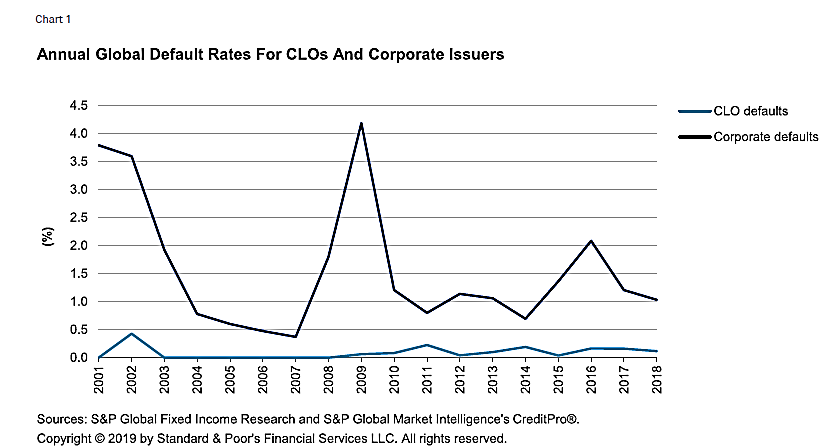

A large portion of the existing literature has focused on the United States, while there are very few studies that consider Europe. The credit systems vary a lot between these two regions since they have different market structure and economic conditions and since they have different regulatory authorities (Chen, 2018). Also, the behaviour of the borrower will not be the same between the two regions. The major reason for having fewer studies for Europe is due to the unavailability of reliable and consistent data for most European countries (Mladovsky, Allin, & Masseria, 2009). A repository known as European Data warehouse (ED) contains partial data that can fill the gap to some extent, which gives the researchers different opportunities to explore the credit market in Europe. The number of loan defaults do not remain constant and has constant variations among the corporate world. The loan defaults rates of corporates globally is shown in figure 1.

Figure 1 Annual Global Default Rates For CLOs and Corporate Issuers

Big Data

The presence of large amount of data in some countries brings in a dilemma on how to process the data since this brings about additional complexities to the analysis. Hence, machine learning algorithms and Big data can be implemented so that the model can be analysed without complicated mathematical models. The use of big data brings about possibilities in creation of larger databases without the issues of space constraints and limitations. The simple structure of the machine learning algorithms can analyse the information available in the ED and may attain better description of the European behaviour.

The ability of machine learning algorithms to predict the financial analysis makes them very much efficient for the regulatory bodies to monitor the finances. CECL and stress tests can be performed using these algorithms to get efficient results. The data must contain various parameters required for the analysis like Loan to Value (LTV), Debt Service Coverage Ratio (DSCR), etc. as the indicators of loan credits. The data from the banks must be updated regularly on a daily or weekly basis so that every transaction is accounted during the analysis.

The regulatory bodies must collect the data and run the model in real time to constantly monitor the parameters (Drotár, Gnip, Zoričak, & Gazda, 2019). This is rather difficult since European countries are diverse with different types of banking cultures, but overall they are similar when compared to American banking cultures. Normally, there will be many missing values in the parameters since they depend on bank corporates to provide the type of data. Hence, different banks would provide different type of data which would completely skew the analysis process. Hence, steps must be taken to make uniform collection of data among the European banks.

Conclusion

The different type of analysis has been seen and discussed for European banks. Analysing the CECL of the banks using machine learning techniques through big data will greatly avoid loan defaults. This will avoid the failure of banks thereby avoiding economic collapse.

References

1. Basel Committee Banking Supervision. (2017). Supervisory and bank stress testing: range of practices. BIS Working Papers. Retrieved from https://www.bis.org/bcbs/publ/d427.pdf

2. Baudino, P., Goetschmann, R., Henry, J., Taniguchi, K., & Zhu, W. (2018). FSI Insights on policy implementation Stress-testing banks – a comparative analysis. BIS Working Papers. Retrieved from https://www.bis.org/fsi/publ/insights12.pdf

3. Chen, G. (2018). Loan Default Analysis: A Case Study For CECL. Retrieved from https://w3.zmfs.com/wp-content/uploads/2018/05/ZConcepts_LoanDefaultAnalysis-ACaseStudyforCECL.pdfhttps://w3.zmfs.com/wp-content/uploads/2018/05/ZConcepts_LoanDefaultAnalysis-ACaseStudyforCECL.pdf

4. Cohen, B. H., & Edwards, G. (2017). The new era of expected credit loss provisioning. BIS Quarterly Review, March. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2931474

5. Drotár, P., Gnip, P., Zoričak, M., & Gazda, V. (2019). Small- and medium-enterprises bankruptcy dataset. Data in Brief, 25, 104360. https://doi.org/10.1016/j.dib.2019.104360

6. European Systemic Risk Board. (2019). Expected credit loss approaches in Europe and the United States: differences from a financial stability perspective. https://doi.org/10.2849/600179

7. McDonald, R., & Paulson, A. (2020). What Went Wrong at AIG? Retrieved February 4, 2020, from https://insight.kellogg.northwestern.edu/article/what-went-wrong-at-aig

8. Mladovsky, P., Allin, S., & Masseria, C. (2009). Health in the European Union: trends and analysis. WHO Regional Office Europe. Retrieved from http://www.euro.who.int/__data/assets/pdf_file/0003/98391/E93348.pdf

9. The Basel Committe. (2006). Principles for the Management of Credit Risk. IFAS Extension, 1–33. Retrieved from http://edis.ifas.ufl.edu/pdffiles/HR/HR02200.pdf

10. The Economist. (2019, September). The economic policy at the heart of Europe is creaking. The Economist. Retrieved from https://www.economist.com/briefing/2019/09/12/the-economic-policy-at-the-heart-of-europe-is-creaking

11. Vazza, D., Kraemer, N., & Gunter, E. (2020). 2018 Annual Global Leveraged Loan CLO Default and Rating Transition Study. Retrieved from https://www.spglobal.com/en/research-insights/articles/sp-global-ratings-global-outlook-2019

- Step by Step Guide to Writing a Professional PhD. Dissertation - February 3, 2021

- What are a big data analytics and how it is being used? Mention the benefits of big data analytics - November 13, 2020

- How to solve some of the difficulties in thesis proposal writing through interaction with their peers in the writing course - October 29, 2020